Small Business & Self‑Employed Loans in Australia: Your Complete Guide 2025

Unlock the best finance options for your business, from low‑doc loans to self‑employed mortgages, with expert advice from Mountway.

Ready to get started?

Getting Started

Running a business is tough work. Long hours, managing staff, paying invoices — and then when you go for finance, you’re often told “sorry, too risky.” Whether you’re a tradie with an ABN, a freelance designer, or running your own café, it can feel like the banks just don’t get it.

Here’s the truth: being your own boss doesn’t mean you have to miss out on a business loan, a mortgage, or equipment finance. In fact, more and more lenders in Australia are tailoring loans specifically for small business owners and the self‑employed.

In this guide, we’ll walk you through the key options — from low‑doc business loans to self‑employed home loans — so you know exactly how to move forward with confidence.

Understanding self‑employed business loans

Banks love predictability. For PAYG employees, that’s simple: two payslips and a tax return. For small business owners? Life looks very different. Your income might be seasonal, invoices drag on, or you might be reinvesting everything back into growth.

None of this makes you a bad borrower. It just makes you harder to fit into the neat little boxes banks like. What you really need is a lender — and ideally a broker — who knows how to tell your financial story so it makes sense to the people tick‑boxing your application.

That’s where Mountway comes in: we help reframe your application in a way that boosts approval chances, whether that’s with a major bank, a non‑bank, or a fintech lender.

Not a fan of long reads?

Check out our YouTube channel for expert insights and all the info you need to know!

Low‑Doc And No‑Doc Loans Explained

What’s a low‑doc loan?

A low‑doc business loan is designed for business owners who don’t have the full two years of tax returns handy. Instead, you may be able to apply with bank statements, BAS, or an accountant’s declaration of your income. Low‑doc loans are common for sole traders and contractors, giving faster access to finance without waiting for the paperwork to catch up.

What’s a no‑doc loan?

A no‑doc loan goes a step further: no income documents required at all. Approval is usually based on security you put up (like property). They are higher risk and come with conditions, so they’re less common, but still an option if you need short‑term funding.

Key takeaways

-

Low‑doc = less paperwork, faster approvals, but often higher rates

-

No‑doc = rare, higher interest, suited to short‑term solutions

-

Great for ABN holders, sole traders, and freelancers stuck waiting on tax returns

Home Loans For The Self‑Employed

The old myth is that being self‑employed means you’re locked out of home ownership. That’s rubbish. We’ve helped countless small business owners get the keys to their dream home. Here’s what you need to know:

Banks are easing up

Lenders now recognise that not every Aussie fits the PAYG mould. Some banks accept shorter business histories, others are OK with BAS or accountant letters.

Fixed vs variable loans

Fixed = predictable repayments for peace of mind. Variable = could save you money if interest rates drop. A good broker helps weigh up which makes sense for your situation.

Watch out for rate hikes

Banks can increase your rate during your loan. We’ll help factor in buffers and options like offset accounts so you don’t get caught short.

Credit ratings matter

Your credit rating is critical. Lenders place more weight on it when they can’t rely on payslips. A strong score can tip the scales in your favour.

What Lenders Are Really Looking For

-

A clean credit history

-

Proof you can handle repayments (cash flow or bank statements)

-

Evidence of tax compliance

-

Financials that show you can weather ups and downs

Pro tip: Keep your business and personal money separate. It makes your lender — and your accountant — a lot happier.

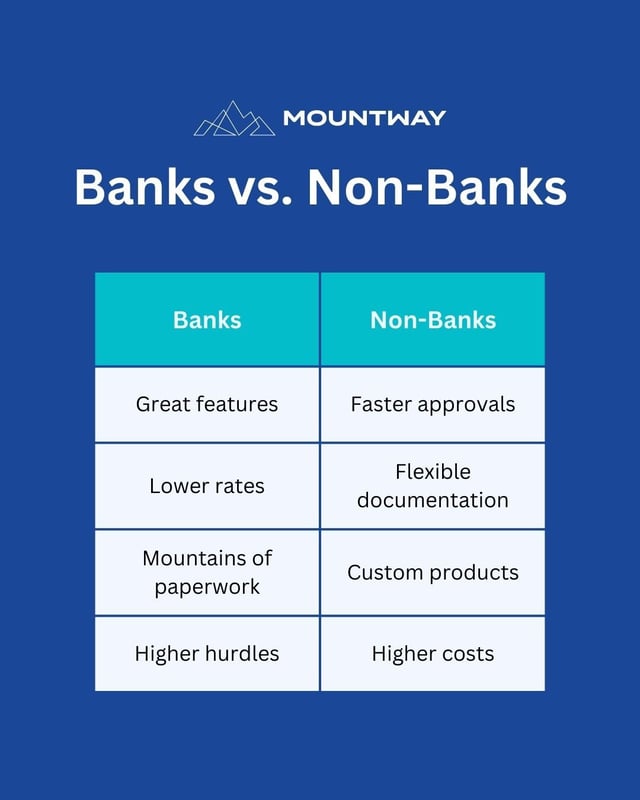

Banks vs non‑bank lenders

-

Banks: Great features, lower rates, but mountains of paperwork and higher hurdles

-

Non‑banks and fintechs: Faster approvals, more flexible documentation, custom products but slightly higher costs

Mountway works across both, so you’re not stuck in one lane.

Government Support And Grants

Loans aren’t the only way to fund your goals. Check these out:

- SME Loan Guarantee Scheme: A government program helping small businesses get easier access to funds.

- State-based grants: Each state offers its own funding options, from expansion grants to equipment upgrades.

- Self-Employment Assistance: Federal support for new entrepreneurs to get off the ground.

Tips to improve your chances

- Keep records clean and up to date

- Build up a savings buffer to show you can handle repayments

- Pay down small debts where you can

- Double‑check your credit rating

- Work with someone who actually understands self‑employed borrowing

Make sure you check out our article on the five financial mistakes that kill small businesses, and how to fix them.

Haven't got time? Let's break it down

How much deposit do I need for a business loan in Australia?

Typically around 20% for secured business loans. For unsecured loans, no deposit is required.

What’s the easiest business loan to get in Australia?

Usually low‑doc business loans or unsecured loans, as they’re faster with less paperwork.

Can I get a loan with an ABN?

Yes, in fact most lenders require an ABN loan to be active at least 12 months.

Can sole traders apply for business loans?

Absolutely, many products are designed specifically for sole traders and freelancers.

Can I get a loan with no proof of income?

No‑doc loans exist, but they’re rare and generally come with higher rates and more conditions.

Still have questions?

We know there’s a lot to take in when it comes to self‑employed and small business loans. If you’re after advice that’s tailored to your situation – or just want to talk it through with someone who genuinely understands the challenges of running your own business – our team of experts is here to help.

Ready to Take the Next Step?

Being self‑employed doesn’t mean you should settle for second‑best when it comes to finance. The truth is, banks often overlook how hard you’ve worked to build your business — but that doesn’t mean you’re out of options.

Whether you’re chasing a small business loan in Australia to unlock growth, a sole trader loan to smooth out cash flow, or a self‑employed home loan so you can finally put down roots, there are lenders and products designed with you in mind.

At Mountway, we understand the unique challenges of running your own show — long hours, irregular income, endless paperwork. That’s why our job is to take that load off you. We help package your financials in the best light, explain your options in plain English, and negotiate directly with lenders so you don’t get stuck in the shuffle.

You focus on running your business. We’ll focus on getting you the right finance solution. Simple, transparent, stress‑free.